Anticipating Mr. Friedman

ANTICIPATING MR. FRIEDMAN

When Restoration Hardware Holdings, Inc. (RH), among the very few retail growth stocks still standing, reports third-quarter earnings after the close of New York Stock Exchange trading on Dec. 10, the ink on these pages may still be damp. You, gentle reader, may already know the results. We jump the gun to compare the words that the company's irrepressible chairman and CEO, Gary Friedman, might say, with the words he has already spoken and with deeds the company has already performed and may perform in the future. Our predisposition is bearish (see Grant's, Jan. 23).

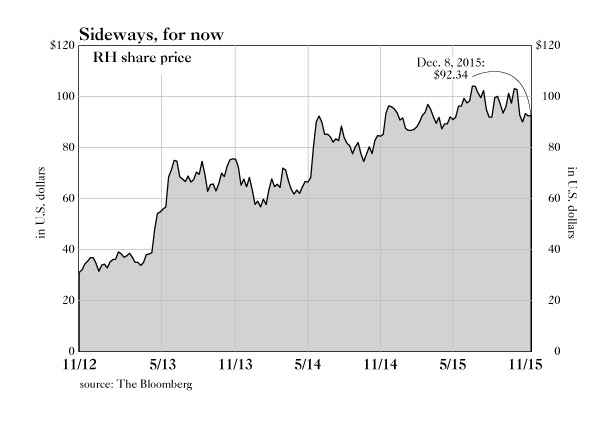

RH share price

RH is a double bellwether. First, of the state of the growth-stock wing of the equity market. Second, of the propensity of well-to-do Americans to consume (at least, to consume furniture, bed and bath accessories, window treatments, lamps, rugs, tableware and miscellaneous décor in shades of beige, white or brown). Since the November 2012 IPO, the dividend-free shares have returned 54% per annum. The question before the house is whether they can continue to levitate and--not to put the cart before the horse--whether Restoration Hardware can continue to generate stair-step growth in earnings. We re-register our doubts.

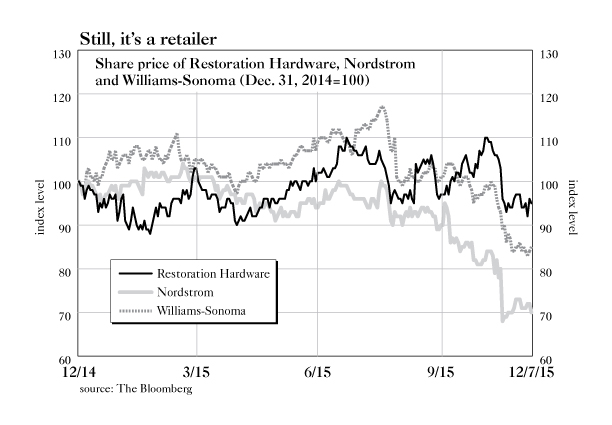

Since August, the share prices of Nordstrom, Tiffany & Co., Williams-Sonoma, Macy's, Burberry and Prada have been on the skids. Disappointing results from RH headquarters in Corte Madera, Calif., would constitute another tile in the mosaic of a weakening retail economy. We don't warrant that the company's results will disappoint. We only observe that, in a sloppy general retailing season and in a wobbly stock market, the shares are priced for everything but disappointment.

Share price of Restoration Hardware, Nordstrom and Williams-Sonoma (Dec. 31, 2014=100)

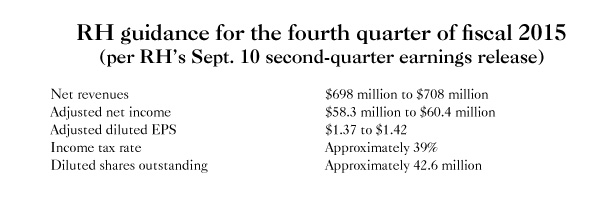

If it's the vintage Friedman who hosts the Thursday call, he will concede nothing to the elements, whether financial, commercial, meteorological or Bezosian. He will rather cheer the home-furnishings curator (not "retailer") of which he continues to own 5.4%. He will talk up prospects for the fiscal year ending Jan. 30, with growth in revenue and net income reaching 16% to 17% and 33% to 37%, respectively. On form, there's a chance that he'll boost guidance for the fourth quarter (when last guided, the Street was encouraged to expect $698 million to $708 million in revenue and $1.37 per share to $1.42 per share in "adjusted" diluted net income). He will hold fast to the long-term goal of delivering $4 billion to $5 billion in annual North American sales, a mid-teens operating margin and "significant" free cash flow. He's got a way to go, and the trudging American economy makes the travel no easier. For the current fiscal year, annual revenue is pointing to $2.1 billion, adjusted operating margin to 10.6% and free cash flow--still--to the color red.

In an earlier epoch of history, a man so driven as Friedman might have led a revolution. As it is, the chief curator of Restoration Hardware seeks to revolutionize the high end of the furniture and décor trades. One means, perhaps the principal means, to this end are 60,000–70,000 square-foot "next-generation design galleries" (not "stores") and 17-pound "source books" (not "catalogs") and, of course, the World Wide Web, which the company has chosen not to rename. To use a word that once connoted the combination of business titan, cheerleader and visionary, Friedman is an "upbuilder." Let some in the RH inner executive circle sell their RH shares, as some continue to do. Let outsiders carp, as Grant's does. Friedman, a non-seller (he acquired the bulk of his shares in the private equity transaction that preceded the IPO) and supreme non-carper, wears a woven brown bracelet on which is visible the word "believe."

Since our January analysis, the stock price has been flat. "Which is not to say," observes colleague David Peligal, "that the price chart is horizontal. Over the past 11 months, RH has zigged and it has zagged, which might be expected since 28% of the float is still short and since the company generally has either met or exceeded sell-side analyst expectations."

On, then, to anticipating what Friedman will and won't say on the earnings call for the third fiscal quarter ended October 31 (readers who wait for Grant's to arrive by post may already have listened to the conference call; early-bird, Web-based readers will be one step ahead of the chief curator as he starts to speak). If past is prologue, "full speed ahead," or words to that effect, will be the Friedman message. If the Street is on the beam (there are 14 buy ratings, six holds), Friedman's pride and joy will deliver adjusted net income of $3.94 a share in the fiscal year ending Jan. 2017, up from the forecast $3.13 a share for the fiscal year ending Jan. 2016. Previously issued guidance is summarized in the nearby table.

Mr. Market and we will be on the alert for backsliding in guidance or signs of operational weakness. The latter may well include a greater than ordinary bulge in inventory. "In a choppy backdrop," said Goldman Sachs on Nov. 20, while demoting the stock to "neutral" from "buy," "we believe aspirational guidance will prove difficult to achieve, and note that the guide [sic] embedded a greater than usual sequential increase in sales from 3Q to 4Q, after accounting for space growth."

It's a cinch that Friedman will harp on the company's building boom, especially on those cavernous next-generation design galleries. More than revolutionary, greater than spectacular, they will assure that the torrid rate of corporate growth will accelerate, or so management says: "We believe that the sheer scope of what we are about to unveil over the course of just three months--September through November--illustrates our execution capabilities, our unmatched level of innovation and the power of our multi-channel platform."

(per RH’s Sept. 10 second-quarter earnings release)

It's a mouthful, but then the next-generation concept is like nothing that retailing had known was even possible. Two such emporia opened in October, in Chicago and Denver, and a third in November, in Tampa. The Denver location replaced a Saks Fifth Avenue store and features two of Friedman's newest business concepts, RH Modern and RH Teen. Seen from a distance, the effect is that of a city block in a touched-up neighborhood in Venice or maybe Florence--in any case, not Denver. Friedman himself could hardly find the words to do justice to this creation. "The Gallery at Cherry Creek," he was quoted as saying in the celebratory press release, "is a study and reflection of human design in regards to balance, symmetry and proportion, while respecting the integration of environment, architecture and humanity to create a feeling of harmony." You could shop there, too, if you wanted, browsing amid "the largest curated and fully-integrated assortment of modern furnishings, lighting and décor under one brand in the world."

The bet at RH is that such outsize structures will generate much larger sales per square foot than the 7,000-square-foot chicken coops in which the company has done its successful legacy business. We have been, and remain, skeptical of this claim--as an unnamed short-seller was quoted as saying in these columns in January, "It's hard to fill a huge store with upper-end customers, because, frankly, there are not as many of them." No doubt, nothing can be, or will be, decided right away, though a subscriber who visited the Denver palace ("We do not build retail stores"--Friedman) at 11:30 a.m. on Wed., Dec. 2 filed this summary report: "There were about six, maybe eight, customers walking around--about two per floor. May have missed one or two who might have been on the elevator."

A scout from this publication visited the new Chicago next-generation gallery, situated at 1300 North Dearborn Parkway, on Monday. The in-store restaurant, called the Three Arts Club Café, was lovely and lively, comes his report, though between 5:25 p.m. and 5:40 p.m. no more than 15 or so people walked through the main entrance. How many diners and sippers at the Three Arts will choose, upon paying their check, to venture to the fourth floor to purchase a Wythe Live-Edge Rectangular Dining Table for $19,995 or an Italia Slope Arm Customizable Sectional for $23,785 remains to be seen. An alert patron would do no such thing when each piece is on offer at a heavily discounted price on the RH Modern Web site.

RH Modern, a new business to the corporate stable, is another certain point of focus on the Dec. 10 call. "Our finest work to date," Friedman had called this bright idea in October: "From antiques to architecture, from the environments we work in to the devices we work with, there is a modern sensibility that is influencing what we see and how we live in the world. While the market for modern furnishings has always been somewhat small, the convergence of these trends creates an opportunity to develop a much larger market." By which Friedman would appear to mean that he is developing a market in everything.

But will they buy furniture?

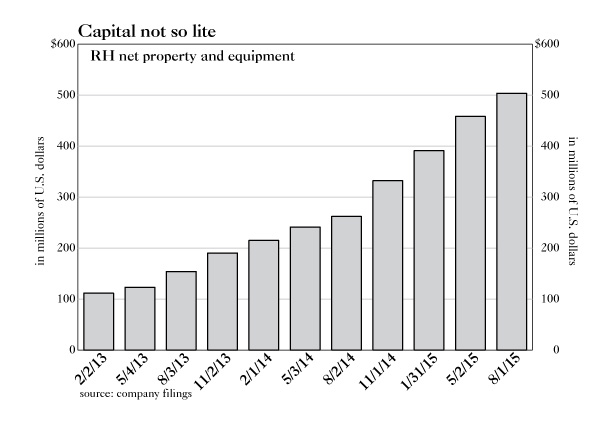

Doubt and uncertainty find no place in the conversation of the chief curator. He addresses them only to dismiss them, as he did in the second quarter. "We are often asked by investors and analysts," Friedman spoke into the video camera, "'How do you think about the threat of online retailers? Why do you believe your strategy of opening larger stores will succeed? What about the risk of complexity? You're expanding into new categories and businesses at an unprecedented pace.'" On Thursday, he'll likely make reference to growth rates already logged, to the sayings of the management guru Andrew Thomas Kearney (1892–1962) and to the words of his own COO, Ken Dunaj. He may repeat the words that he himself spoke on the second-quarter earnings video presentation: "While our model might be capital-heavy, it is also earnings-heavy, which we believe will prove to be significantly more valuable than a capital-lite, earnings-lite model."

The capital-heavy stratagem would hold less appeal in a time of rising interest rates and weakening asset prices than it did during the QE-infused bull market. "Anyway," Peligal observes, "I have a tough time thinking of a retailer that thrived with a strategy of giant stores, besides supermarkets and mass-market vendors like Wal-Mart. To maintain its stunning rate of growth in incremental revenue, RH has had to acquire more and more assets. Net property and equipment at the end of the second quarter was $503.5 million. It was $390.8 million as recently as Jan. 31."

At an Oct. 15 investor presentation that preceded the opening of RH Denver, Friedman addressed the questions that some had raised about the advisability of adding so many bricks and so much mortar to a business model that delivers half of sales via the Web. "A lot of people are looking at the capital load we have--operating capital in inventory and other places--we're expanding our business horizontally, not vertically," Friedman said. "That's less efficient. So while we're expanding and building the platform and the offer, there's some capital inefficiency. But once we start scaling this and our growth moves from kind of this horizontal growth of expanding product, and we hit the inflection point where the square-footage growth grows faster, we think you'll see a better capitalization in our business and improvement in return on invested capital."

In October, Neiman Marcus postponed its IPO, citing adverse market conditions. Just the other day, J.Crew, the private company which is led by Friedman's old mentor, Mickey Drexler, disclosed that, measured year over year, third-quarter sales fell by 6% and gross margin dipped to 38.6% from 40.2%. It would be unlike Friedman to acknowledge that RH breathes the same air as any conventional retailer. Still, there is the risk of managerial ambition running afoul of the business cycle. Second-quarter inventory jumped by 29% from the year-earlier period. The number of days required to sell those goods--e.g., "days of inventory outstanding"--rose to 181 from 163 a year before. Karen Boone, RH's chief financial officer, had this to say on the second-quarter video presentation: "We expect to end the year with inventory growth that is higher than our sales growth given the inventory investments necessary for the launches of RH Modern and RH Teen."

RH net property and equipment

"No doubt," Peligal notes, "Friedman expects to stay ahead of the merchandising curve, but always getting it right is a tall order. When RH hits a rough spot, or when they have a disconnect with their customer, all this inventory--this huge, new fixed-asset base--will present a problem. It's great until you make a mistake. The fact is that RH is just as susceptible to the cycle as every other retailer."

Of course, RH insists that it's no such thing. As its "galleries" are not "stores," neither is the company itself a retailer. Its strategy, like its chairman, is unique--is, indeed, uniqueness. How much easier it is, Peligal points out, for Wal-Mart to achieve a low-cost strategy than for RH to deliver on what boils down to a greatness strategy: "It doesn't mean it's impossible, but do you want to pay a big multiple for a cyclical retailer that requires them to be great merchants for each of the next few years? Some investors will, as growth is hard to find in the retail sector, but it might be a dubious strategy--especially considering we haven't had a recession in more than six years."

Low interest rates pull forward demand and facilitate financing. They have been very good to RH. A $350 million issue of zero-percent convertible senior notes due in 2019, which was privately placed last year, is trading at 99; a $300 million issue of zero-percent convertible senior notes due in 2020, which was privately placed in June, is quoted at 95.5. "We have taken important steps to strengthen our balance sheet," says Boone on the second-quarter video presentation. "As you know, we executed our second zero-coupon convertible debt offering earlier this year, and now have the capital to execute our strategy in any economic environment. It's also important to know that we also executed a hedge transaction that prevents dilution from the convertible bonds until our market cap reaches nearly $8 billion. The hedge is also tax-deductible, further reducing the cost of this extra capital." On Sept. 25, the CFO exercised and sold 20,000 shares through a 10b(5)-1 plan. She directly holds no shares.

"A lot of times," Peligal winds up, "a company puts up a string of good quarters, and the beaten-down short-seller throws in the towel and moves on to something else. In other words, RH's success thus far has not necessarily changed anyone's view of what the endgame looks like. Short-sellers are still waiting for signs of a crack--sales growth to decelerate, gross margins to track lower, inventories to push higher, expenses to rise in a reflection of the difficulty of running a bigger, more complex operation. And remember, RH is still an organization which very much goes through Friedman and is a bet on his continuing to execute flawlessly."

•

Not a subscriber? Click here