Five Below

From the Financial Times:

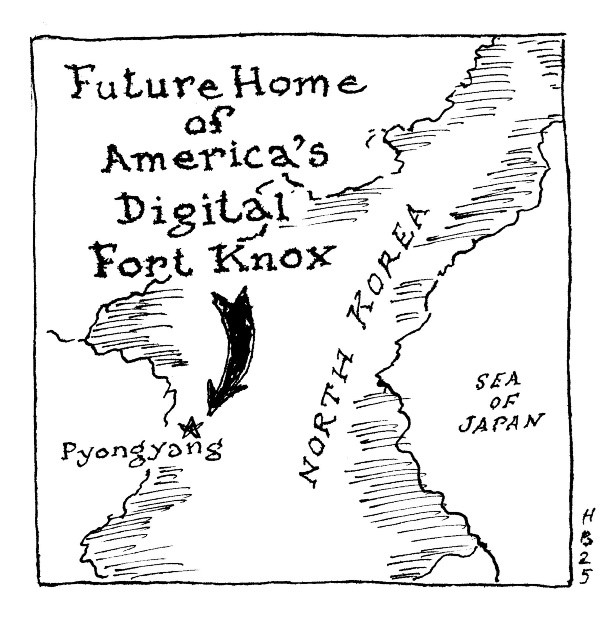

The Pentagon is making a $400 million direct investment in a US rare earths producer, in an unusual arrangement highlighting the Trump administration’s determination to break Chinese dominance of critical minerals and bolster domestic supply chains.

MP Materials on Thursday said the Pentagon would become its largest shareholder, taking a 15% stake in the company, as well as investing billions of dollars to build a 10,000 metric ton magnet manufacturing facility — expected to begin preparing for operations in 2028. . .

Rare earth magnets are critical for weapons systems including the F-35 Lightning II fighter jet, unmanned Predator drones and the Virginia- and Columbia-class submarines. One F-35 needs 900 pounds of rare earths. They are also found in Tomahawk missiles and bombs for a guidance system developed jointly by the US Air Force and Navy.

Moon Companions

Rugged individualism, writ large:Rugged individualism, writ large: retail investors are sitting pretty these days, as Mr. Market has handsomely rewarded the group’s dip-buying proclivities. Thus, a policy of going long the Nasdaq 100 after the index logged a red showing in the prior session has returned 31% so far this year, Bank of America found last week, far eclipsing the tech-heavy gauge’s 8% return over that period and trailing only the plague year for the strategy’s best performance dating back to 1985.

Then, too, ProShares UltraPro QQQ (ticker: TQQQ) – which aims to generate three times the Nasdaq 100’s daily performance – garnered record inflows during the spring tariff convulsions, with that exchange-traded fund more than doubling from its April 8 close. “Pops and drops will occur. . . but the dip-buying belief has become the new religion,” Mike Zigmont, co-head of trading and research at Visdom Investment Group, told the Financial Times Monday.

Considering those remunerative outcomes, it is little surprise that retail investors have shunted a net $155.3 billion into U.S. equities and ETFs from January through June per Vanda Research, the largest first half sum on record. Active trading (or is that hyperactive?) accompanies that shopping spree, with retail’s average daily turnover by dollar value jumping 44.5% year-over-year. As Bianco Research points out, only locked-down 2020 saw a larger annual increase in activity during the past decade.

As with the 2021 meme stonk phenomenon, today’s potent retail impulse has redounded to the benefit of various highly-speculative names. Citing data from Bespoke Investment Group, The Wall Street Journal relayed last weekend that the 858 unprofitable Russell 3000 members rallied by 36% on average since April 8, comfortably outpacing the Russell’s 26% return over that stretch. All but four of the 14 index components that have tripled over that period likewise operate in the red.

One noteworthy example: shares of Aeva Technologies (ticker: AEVA) are up 440% since the Liberation Day kerfuffle, valuing the developer of lidar sensors for self-driving cars near $1.5 billion. The firm posted $3.4 million in first-quarter revenues, alongside a $30.5 million operating loss.

“We’re not yet seeing a full-fledged ‘flight-to-crap,’ but it is clear that the motivation behind many of these stocks’ activity is something other than disciplined considerations of discounted cash flows,” Steve Sosnick, chief strategist at Interactive Brokers, told the WSJ.

With the major indices back at record highs, will the now-flush retail crowd opt to take some chips off the table? Don’t count on it, analysts at JPMorgan wrote Wednesday, anticipating $360 billion of equity inflows in the back half of 2025. Overseas individuals will snap up a further $50 billion to $100 billion of U.S. stocks through year-end, the bank predicts, writing that “investors cannot avoid the biggest and most important growth segment of global equity markets.”

Buy the dip, buy the rip.

Recap July 11

Treasurys came under pressure with 2- and 30-year yields rising 4 and 10 basis points, respectively, to 3.9% and 4.96%, while stocks settled slightly lower after recovering most of another tariff-induced overnight drop, wrapping up a relatively low-wattage week with a flat showing for the S&P 500. WTI crude advanced towards $69 a barrel, gold jumped to $3,357 per ounce, bitcoin blasted off to $118,000 and the VIX ticked above 16.

- Philip Grant

Friend Zone

We've got boots on the ground:We’ve got boots on the ground: The European Union is set to admonish the Italian government for purported interference with UniCredit SpA’s planned takeover of peer Banco BPM, Bloomberg reported Tuesday, as Brussels looks to overrule the member state’s “harsh conditions” on a combination between two of its four largest lenders by market capitalization.

Forthcoming EU action “could eventually pave the way for an order for the Italian government to withdraw the terms it imposed” on UniCredit’s approach, Bloomberg relays. For their part, “Italian officials were uncharacteristically quiet Tuesday,” indicating “that the move surprised most politicians in Rome.” That prospective tie-up would continue a tidal wave of consolidation within Italy’s banking system, as five major mergers have been announced since November.

***

Against that volatile, dynamic backdrop, one niche player has quietly enjoyed smooth sailing, with BFF Bank SpA (ticker: BFF IM) returning 32% in dollar terms since a bullish analysis in the Dec. 20 edition of Grant’s Interest Rate Observer. The S&P 500 is up 6.5% over that stretch.

No ordinary borrow-short, lend-long outfit, BFF was founded in 1985 by a coalition of large pharmaceutical companies to collect accounts receivable owed by the Italian government. Four decades later, factoring receivables delivered 57% of first quarter revenues, while payments, custodial and deposit services and interest income – primarily from its government bond portfolio – accounted for the rest.

“BFF isn’t run like a typical Italian company,” Vitaliy Katsenelson, CEO of Investment Management Associates, advised Grant’s late last year. “Their internal language is English, and they have a hardworking culture.” Investor-aligned management also features in the bull case, as long-tenured CEO Massimiliano Belingheri, who has held his position since 2013, remains BFFs largest shareholder with a 5.8% stake.

Often slow-paying, Italy (which accounts for 62% of its factoring book) and other EU governments eventually fork over what is due, so credit losses remain negligible. Yet a spring 2024 regulatory shift helped throw shareholders for a loop, as the Bank of Italy began requiring the firm to mark any paper past due by at least 180 days as non-performing, with that rule applying to any outstanding invoice from a delinquent borrower. Previously BFF was permitted to classify such past-due claims as performing, provided there was some measurable progress towards collecting payment.

Consequently, problem assets registered €1.82 billion as of March 31 compared to €324 million in the same period in 2024. With capital requirements commensurately rising sharply, the company was obliged to suspend its dividend last May, sending shares lower by a quick 34%.

By way of response, BFF tweaked its accounting practices, recognizing upfront a greater share of interest it earns on late payments to burnish reserves. The company likewise managed to whittle down past-due accounts by 5% over the three months through March, while growing its Italian factoring volumes by 10% year-over-year.

As a result, the common equity tier 1 capital (CET1) ratio jumped 143 basis points on a sequential basis to 13.7% in the first quarter, topping the 13.5% seen right before the Bank of Italy’s stringent new rules came into effect. Notably, the current figure comfortably tops management’s prior 12% bogey at which they would distribute all earnings to shareholders. “We expect an acceleration in [past-due] reductions in the coming quarters,” analysts at Deutsche Bank predicted on June 19, noting that a 50% downshift in that backlog could push CET1 to a hefty 17%.

Might a regulatory green light for renewed shareholder payouts be on the horizon? “We expect that the bank of Italy’s ban on dividend distribution will be removed sooner than later,” DB concluded.

QT Progress Report

Reserve Bank credit stands at $6.613 trillion; little changed over the past week. The Fed’s portfolio of interest-bearing assets is down $14 billion from this time last month and sits 25.8% below its early 2022 peak.

Recap July 10

Stocks fluttered higher by 0.3% on the S&P 500 to confer fresh highs on that blue-chip gauge, with bitcoin ascending to its own record north of $113,000. Treasurys finished little changed across the curve, while WTI crude ebbed below $67 a barrel, gold rose to $3,324 per ounce and the VIX remained south of 16.

- Philip Grant

Red Zone

Field general calls an audible, via CNBC:

Former New York Giants quarterback Eli Manning is no longer interested in buying a minority stake in his old team, telling CNBC Sport Wednesday that he’s been priced out. “Basically, it’s too expensive for me,” Manning told CNBC Sport in an interview. “A 1% stake valued at [near] $10 billion turns into a very big number.”

Manning’s comments come as NFL team valuations skyrocket. In CNBC’s Official NFL Team Valuations published in September, the Giants were valued at $7.85 billion, ranking fourth among the league’s 32 teams.

In December, the Philadelphia Eagles sold a minority stake in the team at a valuation of $8.3 billion — roughly $1 billion higher than where CNBC Sport had valued the team a few months earlier.

Spice Rack

Pass the hot sauce:Pass the hot sauce: Professional investors are turning to the derivatives market to beef up their bond market returns, as net short positions within Markit’s U.S. investment-grade credit default swap (CDX) gauge now top $105 billion according to Barclays and Bloomberg-compiled data, the largest sum in at least three years.

Those instruments, which conventionally served to hedge against individual or broad corporate stress, have evolved into a tool for generating extra income on existing bond portfolios as part of a “structural shift,” strategists at Bank of America reckon.

Ample liquidity, meanwhile, burnishes credit default swaps’ appeal for portfolio managers, with $1.2 trillion of the products changing hands across North America and Europe during April’s trade-related tumult. “You can easily do $500 million of CDX high-yield today,” Martin Coucke, global credit portfolio manager at Schroders, relates to Bloomberg. “Buying $500 million of bonds today on the high-yield side is close to impossible.”

Yet alongside that virtue comes basis risk, meaning an imperfect correlation between the swaps and underlying corporate obligations. Thus, the IG CDX reached a 63% premium to its year-end 2024 levels following Liberation Day, well above the 49% jump in equivalent benchmark bond spreads. “This activity is implicitly short volatility,” cautions Bloomberg’s chief global derivatives strategist Tanvir Sandhu. “There are casualties littered throughout history for those trying to boost income but on the wrong side of volatility.”

Still and all, those looking to wager on continued smooth sailing in corporate credit have a new vessel at their disposal. This morning, Reckoner Capital Management launched the Reckoner Leveraged AAA CLO exchange-traded fund, offering up to 50% gearing on top-rated paper within collateralized loan obligations (i.e., packaged and securitized collections of debts backing leveraged buyouts).

“We think of this as a natural evolution of the CLO market,” Reckoner co-founder and CEO John Kim told Bloomberg. “There’s relatively little risk of default in CLOs, and banks are quite willing to provide financing against them.” Indeed, some institutional investors are borrowing up to eight or nine times the initial cash outlay on their top-rated CLO holdings, the executive relays.

Growing leverage within another heretofore-humdrum credit category, meanwhile, raises alarm across the pond. In the latest edition of its biannual financial stability report, the Bank of England noted today that hedge funds are borrowing £77 billion ($105 billion) in gilt repurchase agreements to juice up basis trades – i.e., purchasing cash bonds while selling futures in an attempt to arbitrage the price difference. That’s up from just over £30 billion at this time last year.

What’s more, a “small number” of funds account for 90% of those net gilt repo borrowing, the BoE finds. As a result, “a rapid unwind of leveraged positions by a few key players could amplify shocks during periods of high volatility.”

Don’t forget the ice water.

Recap July 9

Stocks enjoyed a solid 0.6% rebound on the S&P 500 to return to the cusp of recent highs, while Treasurys also caught a bid with 2- and 30-year yields declining four and seven basis points, respectively, to 3.86% and 4.87%. WTI crude stayed at $68 a barrel, gold edged higher to $3,314 per ounce, bitcoin climbed towards $111,000 and the VIX sank below 16.

- Philip Grant

Island Hopping

From the Financial Times:

The number of companies applying for a listing in Hong Kong this year has hit an all-time high, as the territory tries to regain its status as a top financial hub and attract Chinese companies looking to expand abroad.

A total of 208 companies applied for primary or secondary listings on the Hong Kong Exchange in the first six months of this year, beating the previous record of 189 companies in the same period in 2021, according to data from the exchange. Last month, 75 companies applied — a record number for a single month.

Companies have been attracted by Hong Kong’s soaring equity market, Chinese investors moving money into the territory and its relative openness to equity fundraising compared with the mainland. Chinese companies have also been attracted by the prospect of raising money in a currency pegged to the U.S. dollar outside of China’s capital controls.

Direction of Travel

A narrow subset of stocksA narrow subset of stocks have powered the S&P 500’s recent run to a new record close, with the tally of New York Stock Exchange components logging fresh highs outpacing those probing new lows by only 88 per analysts at Oppenheimer. Going back to 1972, such an index-level peak alongside fewer than 100 net new highs has augured substandard returns for the blue-chip gauge over the subsequent 12 months, the firm finds.

“Broader participation is important,” Oppenheimer senior analyst Ari Wald told Bloomberg. “Rallies with most stocks participating, both large and small, are the rallies that typically continue.” Instead, a familiar mega-cap technology cohort has shouldered the bullish load of late, with the Magnificent Seven racking up a 36% advance from the April lows, compared to 25% for the S&P 500.

Might President Trump’s continued clamor for lower borrowing costs pave the way for improved market breadth and more sustainable strength? “A lot of powerful positive forces for stocks are being held up by abnormally tight [monetary] policy, and I think they’re getting close to changing that,” commented independent strategist Jim Paulson.

Yet the Commander in Chief’s renewed “tariff man” posture could complicate that blue sky backdrop for stocks. Thus, a Duke University cum Federal Reserve-conducted survey of U.S. chief financial officers found that firms directly exposed to tariff-related costs planned to raise prices by 6.6% this year on average, with those unimpacted by such levies still anticipating 3.2% price hikes.

“The concern you’d have in this environment is. . . [that] price pressures broaden beyond those that are just directly impacted” by tariffs, Atlanta Fed economist Brent Meyer told Reuters today. “We’re seeing some evidence of that, at least an expectation.”

A separate global poll of 10,000 companies undertaken by Dun & Bradstreet, meanwhile, evinced lasting angst over tariff-induced disruption, with captains of industry broadly battening down the hatches. “The overall economic concern is not going to be short-lived,” D&B chief global economist Arun Singh related to Reuters. “There’s a delay in capital expenditures. They’re delaying payment to their vendors. . . They’re trying to de-lever.”

Tell that to Mr. Market. Noting that interest rate futures price in nearly 100 basis points of rate cuts over the next 12 months while the Goldman Sachs’ U.S. Cyclicals Index trades at the highest premium to defensive names (excluding commodities) since the start of the year, Apollo chief economist Torsten Slok argues that “either the bond market is wrong, and rates must move higher due to accelerating growth. Or, equity markets are wrong, and stocks have to move lower because growth is slowing down.”

Recap July 8

Stocks fluttered through a flat showing on the major indices following yesterday’s moderate pullback, while the long bond ticked higher by two basis points at 4.94% with 2-year yields holding at 3.9%. WTI crude edged above $68 a barrel, gold retreated to $3,302 per ounce, bitcoin climbed towards $109,000 and the VIX ebbed below 17.

- Philip Grant

Hue and Outcry

From The Wall Street Journal:

Thousands of jostling traders once packed the floors of Chicago’s futures exchanges, before the advent of high-speed computerized trading turned them into relics of a bygone era. Now, some of them will finally have their day in court.

On Monday, a trial is set to begin in a long-running class-action lawsuit filed by traders who say that exchange giant CME Group duped them out of the privileges they held as members of the city’s once-elite community of floor traders.

The plaintiffs, who estimate that they are owed about $2 billion in damages plus interest, say the company broke its promises to them when it opened a data center for electronic trading that effectively doomed the old trading floors. CME has called the lawsuit baseless.

A spokeswoman for CME declined to comment. The company repeatedly tried to get the suit thrown out, but failed each time.

Rubber Stamp

Sign, sign, everywhere a sign:Sign, sign, everywhere a sign: Tokenized money market and Treasury bond mutual funds are all the rage in 2025, the Financial Times relays today, with assets within that category reaching $7.4 billion per data firm RWA.xyz, up 80% in the year to date. Such blockchain-based vehicles managed by BlackRock, Franklin Templeton and Janus Handerson have seen their combined AUMs triple since the new year.

Underpinning that rapid adoption: tokenized funds boast truncated settlement times (typically minutes rather than days for analog versions), which help mitigate capital requirement-related headaches. Cheaper administration expenses represent another virtue.

Crypto aficionados can park their excess cash in such products, as the format “is easy to use and, unlike most stablecoins, allows them to earn a yield,” writes Moody’s analyst Stephen Tu. The market for tokenized mutual funds, bonds and exchange-traded notes could eventually reach a combined $2 trillion by 2030, McKinsey speculated last month, compared to today’s $7 trillion in domestic money market assets.

The prospect of broader blockchain-based finance has investors in a lather. Beginning last Monday, shares of Robinhood enjoyed an 18%, three-day rally on heavy trading volumes (more than 100 million shares changed hands in each of those sessions, compared to 29.5 million shares in average daily turnover over the past year) after the Gen Z-friendly trading app enabled users in Europe to trade tokenized versions of U.S. equities, as well as high-profile private concerns such as OpenAI and SpaceX.

“The time is now for crypto to move beyond bitcoin and memecoins and introduce fundamental utility,” CEO Vlad Tenev commented on Bloomberg Television last week. “We think [that] in the future crypto and traditional financial services will fully merge, and crypto will become the infrastructure layer behind all kinds of financial services, from payments, which you’re starting to see with stablecoins, to holding deposits.” To commemorate the rollout, Robinhood gifted €5 ($5.85) of OpenAI and SpaceX tokens to each eligible European who joined the platform through July 7.

Yet importantly, Robinhood will maintain the ownership in the equity backing those tokens via a special purpose vehicle, leaving hodlers without voting rights. For its part, Sam Altman’s outfit expressed less-than enthusiastic sentiments toward the innovation, declaring thus on X:

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful.

By way of response, Tenev took to the social media platform to make his case:

While it is true that they aren’t technically ‘equity,’ the tokens effectively give retail investors exposure to these private assets. Our giveaway plants the seed for something much bigger, and since our announcement we’ve been hearing from many private companies that are eager to join us in the tokenization revolution.

Will the powers that be put the crimps on Tenev’s grand designs? “We have contacted Robinhood and are awaiting clarifications regarding the structure of OpenAI and SpaceX stock tokens, as well as the related consumer communication,” a spokesperson for the Bank of Lithuania, which acts as the firm’s lead regulator in Europe, told CNBC this morning. “Only after receiving this information will we be able to assess the legality and compliance of these specific instruments.”

Better to ask for forgiveness than permission.

Recap July 7

Stocks turned lower by 0.75% on the S&P 500 following the unwelcome return of “tariff man,” as President Trump renewed his threats to impose steep trade levies on various partners. Treasurys came under bear steepening pressure with 2- and 30-year yields rising two and six basis points, respectively, to 3.9% and 4.92%, while WTI crude rallied to $68 a barrel and gold shook off an early selloff to finish roughly flat at $3,336 per ounce. Bitcoin stayed at $108,000 while the VIX rose modestly towards 18.

- Philip Grant

Flame Out

From Barron’s:

This year, total spending for Fourth of July festivities dropped 5.3% from last year to $8.9 billion, according to survey data from the National Retail Federation. Of the people surveyed, 61% will participate in cookouts, picnics and barbecues, down 5% from last year.

Pricier hamburgers could be one factor discouraging some Americans from opening their doors for an annual cookout.

The average price of ground beef rose 11.5% to $6.25 a pound in May from a year earlier, according to consumer price index data from the Bureau of Labor Statistics. The average monthly price of ground beef has shot up 31% since 2020, based on 2025 data through May.

Public Consumption

Paying the cost to be the boss:Paying the cost to be the boss: Meta Platforms continues to splash out torrents of cash in service of its artificial intelligence ambitions, with OpenAI boss Sam Altman recently claiming the firm is dangling $100 million signing bonuses at some key employees to build talent at its nascent Superintelligence unit. The Facebook parent likewise forked over $14.3 billion for a 49% stake in data labeling startup Scale AI alongside the services of co-founder Alexandr Wang.

In tandem with that aggressive talent acquisition push, Mark Zuckerberg’s outfit is seeking to raise $29 billion from private credit and equity firms to fund new data centers, the Financial Times relayed last week. On April 30, Meta bumped its full-year capital expenditures estimate to $72 billion from a $60 to $65 billion range provided in January. For context, capex footed to less than $40 billion in 2024.

The AI arms race ushers in noteworthy belt-tightening at a fellow Silicon Valley mainstay, as Microsoft commenced a round of layoffs this week which will reportedly reach 9,000 positions, equivalent to 4% of corporate headcount. That “right sizing” comes on the heels of a 6,000-seat culling in May and accompanies a projected $80 billion in capex over the 12 months through June, nearly double the $45 billion outlay during the prior fiscal year. “We continue to implement organizational changes necessary to best position the company and teams for success in a dynamic marketplace,” a company flack put it to the press.

Indeed, big tech’s hefty AI-related outlays may usher in their own dynamic changes for investors. See the brand-new edition of Grant’s Interest Rate Observer dated July 4 for a closer look at the state of play within that lynchpin group, which has achieved financial dominance on the back of abundant cash generation and outsized returns on invested capital.

Part and parcel with the AI revolution: a supersonic boom in data centers powering the technology. Capital spending within that category reached $134 billion over the three months through March per a June 17 report from Dell’Oro Group, up 53% year-over-year. Demand for AI compute services is “unlike anything we’ve seen before,” Amazon CEO Andy Jassey commented in April. “As fast as we actually put the capacity in, it’s being consumed,” he added on May's earnings call.

A commensurately awe-inspiring supply response is underway, with analysts at Wood Mackenzie pegging 134 gigawatts (GW) of current data-center construction projects in the U.S. alone. That’s up from a 50GW pipeline at this time last year and compares to 60GW of existing global capacity, excluding China. Domestic energy demand, which grew at a trifling pace from 2005 through 2021, is set to balloon by 21.5% over the next decade if projections from the North American Electric Reliability Corp. are on target.

On that score, eye-catching developments cross the wires on a seemingly daily basis. To wit: Bloomberg reported Wednesday that OpenAI will lease 4.5GW of computing power from Oracle beginning in fiscal 2028, “an unprecedented sum of energy that could power millions of American homes,” in return for roughly $30 billion per year. To help fill that order, Oracle plans to develop several new data centers across 50 states.

Considering investors’ seemingly boundless enthusiasm for all things AI, it’s fair to say that today’s blue-sky expectations had better pan out for some richly valued players. See the June 6 edition of Grant’s Interest Rate Observer for a bearish analysis of one utility that “trades like a bouncy tech play” and is exposed to a future decline in wholesale energy prices, and the June 20 issue for the bear case on a data center site-preparation outfit facing a shortening backlog and sporting some idiosyncratic corporate foibles.

QT Progress Report

Reserve Bank credit ebbed by $13.3 billion over the past week, leaving the Fed’s portfolio of interest-bearing assets at $6.615 trillion. That’s down $11 billion from the first week of June (well below the $40 billion monthly cap) and 25.9% from the March 2022 peak.

Recap July 3

Stronger than expected June payrolls sent the bulls thundering into the long weekend, with the S&P 500 advancing 0.8%, likewise pressuring the Treasury complex with 2- and 30-year yields rising to 3.88% and 4.86%, respectively. WTI crude hovered near $67 a barrel, gold pulled back to $3,327 per ounce, bitcoin reached the cusp of $110,000 and the VIX stayed below 17.

Finally, the House of Representatives gave their final approval for President Trump’s sprawling spending bill, adding at least $4 trillion to the national debt by 2034 and eliciting a pointed response from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

In a massive fiscal capitulation, Congress has passed the single most expensive, dishonest, and reckless budget reconciliation bill ever – and, it comes amidst an already alarming fiscal situation. Never before has a piece of legislation been jammed through with such disregard for our fiscal outlook, the budget process, and the impact it will have on the well-being of the country and future generations.

Whatever financial problems the future may hold, a bond shortage is unlikely to be one.

- Philip Grant

The Doll

They're quite exquisite! From the New York Post:

Some Yankees fans are apparently just as fervent about iconic “Seinfeld” character George Costanza as they are for the team’s legends, as pre-sale prices for the bobblehead of Costanza sleeping under his Yankees office desk are going for more than tickets to the Aug. 21 game, when they’ll be given to the first 18,000 fans.

As of Tuesday morning, there were multiple sold listings on eBay for the bobblehead for over $200 and as high as $250. Meanwhile, tickets for that day’s game against the Red Sox can be had for as low as $52 including fees on Vivid Seats. . . A recent Aaron Judge Superman bobblehead given out at a game on June 20 has been selling for over $100 on eBay.

Plant and Property

Everything must go:Everything must go: an eye-catching debt deal illustrates freewheeling financial conditions on the Old Continent, as Flora Food Group BV managed to sell €400 million ($471 million) of senior unsecured notes of 2031 at an 8.625% coupon. Proceeds are earmarked to repay dollar- and euro-pay notes coming due in May 2026 and to bolster cash on the balance sheet.

KKR-backed Flora is likely to garner a triple-C-plus rating for that paper, Bloomberg relays, which would mark Europe’s most speculative primary market transaction in nearly a year. The yield on that offering stands nearly four hundred basis points below a gauge of similarly-rated bonds, while brisk demand helped the deal progress from start to finish within a single day.

Analysts at CreditSights, meanwhile, point out that Flora had previously planned to address next year’s maturities via existing liquidity and corporate cash flows. Accordingly, “the fact that the company decided to tap the market instead, in our view, means that either this is an opportunistic move given a favorable market backdrop. . . cash flow generation in the coming quarters may be below expectations, or, perhaps, a combination of these factors.”

In any event, Flora’s foray aptly demonstrates today’s ravenous risk appetite, as European junk bond issuance reached €22.5 billion last month, marking the strongest June on record after topping 2021’s prior peak by nearly €4 billion.

Europe’s high-yield bond funds have, in turn, attracted net inflows for seven consecutive weeks according to EPFR, including a hefty $922 million haul over the week ended June 25. “There’s a huge amount of money coming into the asset class,” Insight Investment Management high-yield portfolio manager Catherine Braganza told Bloomberg today. “Issuance is just reflecting that.”

A steadily rising stateside tide has likewise supported a packed issuance calendar, as June’s $37.4 billion in junk supply marked the largest single-month tally since the 2021 bacchanal. Bloomberg’s U.S. High-Yield Index, meanwhile, just wrapped up an 11th consecutive quarterly gain, its longest winning streak since the late 1990s.

Against that fair-weather bicontinental backdrop, the Grant’s Interest Rate Observer-dubbed “Epitome of the cycle” (Dec. 15, 2017) makes its move: Double-B-plus rated SoftBank Group Corp. has kicked off a combined seven-part, euro- and dollar-denominated bond offering Tuesday, with pricing expected tomorrow.

“We are not surprised to see SoftBank tap the market given its hefty cash needs over the next 12 months,” CreditSights commented this morning, as the risk-happy technology conglomerate promised to “immediately” begin deploying $100 billion towards its Stargate artificial intelligence project announced in January.

Any benefits from SoftBank’s AI ambitions would, of course, accrue to creditors only in the form of the return of their principal, alongside the contractually agreed-upon interest. Noting that the firm’s financial policy, which calls for maintaining cash sufficient to cover two years of bond redemptions, makes no mention of other liabilities such as margin loans and prepaid forward contracts, the analysts conclude thus: “given the perennial governance risk which comes with this name, this does not provide a lot of reassurance. . . we view the risk [versus] reward that comes with these investments as more favorable for equity holders.”

Recap July 1

Big tech came under some pressure to begin the third quarter with the Nasdaq 100 absorbing a near 1% decline, while the rest of the stock market fared better with the S&P 500 trading flat and the Dow Jones Industrial Average rising about 1%. Treasurys saw a bear-flattening move with two-year yields rising six basis points to 3.78% while the long bond held steady one percentage point higher, while WTI crude advanced towards $66 a barrel and gold jumped to $3,338 per ounce. Bitcoin ebbed to $105,500 while the VIX hovered just below 17.

- Philip Grant

Agent Zeroes

From Bloomberg:

Two men who worked for a private business that provides services for companies filing to the Securities and Exchange Commission’s EDGAR system, were charged with insider trading after allegedly pocketing $1 million by stealing non-public information obtained through their jobs. . .

Prosecutors say that between March and June 2025 the pair engaged in a scheme to obtain information about the companies, which announced they had entered into merger agreements “that resulted in significant increases in the share price of each company’s stock.”

Bill of Sale

“Wall Street strategist Tom Lee is aiming to create the MicroStrategy of Ethereum,”“Wall Street strategist Tom Lee is aiming to create the MicroStrategy of Ethereum,” trumpets a Monday headline from CNBC, as the network relays that Fundstrat’s co-founder will join BitMine Immersion Technologies (ticker: BMNR) as chairman of the board.

The crypto mining firm, which sported a diminutive $26 million market cap as of Friday, likewise announced plans for a $250 million private placement, with proceeds earmarked to acquire the digital currency as a so-called treasury reserve asset. By way of reaction, shares rose by 695%.

The supersonic boom in all-things stablecoin (i.e., dollar-adjacent crypto tokens), demonstrated by industry mainstay Circle Internet Group’s near 500% moon shot from its June 4 IPO, alongside the Senate’s passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, underpins that business-model pivot. “Stablecoins have proven to be the ‘ChatGPT’ of crypto, leading to rapid adoption by consumers, merchants, and financial service providers,” Lee contended. “Ethereum is the blockchain where the majority of stablecoin payments are transacted. . .and thus, ETH should benefit from this growth.”

BitMine’s ethereum embrace puts a new twist on the wholesale corporate adoption of the bitcoin treasury movement, with two dozen firms following in the footsteps of crypto evangelist Michael Saylor in the last 30 days per Bitcointreasuries.net. See the current edition of Grant’s Interest Rate Observer dated June 20 for more on that financial fad, and the June 6 edition for a closer look at stablecoins’ purported promise and potential pitfalls.

The firm formerly known as MicroStrategy, meanwhile, continues to feed the quacking ducks via prodigious equity issuance after expanding its combined class A and B common share count to 273.4 million on May 2 from 202.6 million six months earlier. According to a Monday SEC filing, Strategy sold a further 1,334,000 common shares last week under its at the market (ATM) offering program, netting $520 million in proceeds. As Jim Chanos points out on X, the firm is now funding cash dividend payouts on its preferred stock via the common stock ATM.

Recap June 30

The second quarter wrapped up in familiar fashion as stocks tacked on another half-percentage point advance on the S&P 500, leaving the blue-chip gauge higher by 6% in the year-to-date and 21% north of its April 8 close. Treasurys enjoyed a bull-flattening rally with the long bond dipping seven basis points to 4.78% while the two-year ticked to 3.72% from 3.73%, while WTI crude ebbed just below $65 a barrel and gold bounced to $3,305 per ounce. Bitcoin hovered above $107,000 while the VIX rose towards 17.

- Philip Grant

HAL in the Family

From the Financial Times:

The six largest U.K. accounting firms do not formally monitor how automated tools and artificial intelligence impact the quality of their audits, the regulator has found, even as the technology becomes embedded across the sector.

The Financial Reporting Council on Thursday published its first AI guide alongside a review of the way firms were using automated tools and technology, which found “no formal monitoring performed by the firms to quantify the audit quality impact of using” them.

The watchdog found that audit teams in the Big Four firms — Deloitte, EY, KPMG and PwC — as well as BDO and Forvis Mazars were increasingly using this technology to perform risk assessments and obtain evidence.

But it said that the firms primarily monitored the tools to understand how many teams were using them for audits, “typically for licensing purposes,” rather than to assess their impact on audit quality.

Capitol Idea

To infinity, and beyond:To infinity, and beyond: Artificial intelligence is yesterday’s news in the booming exchange traded fund business, Bloomberg reports, as issuers such as Roundhill Investments and KraneShares have turned to far-flung concepts such as humanoid robots (i.e., machines resembling people), quantum computers and even UFOs.

A pair of humanoid-focused funds have debuted since the start of June, attempting to capitalize on a market which could reach $5 trillion by 2050 according to Morgan Stanley. “In China, these robots are already in market and will be coming to. . . the U.S. in the near future,” predicted Roundhill CEO Dave Mazza, whose firm launched an actively-managed humanoid ETF yesterday. “We’re approaching a [Chat]GPT moment for humanoids,” concurred Derek Yan, senior investment strategist at KraneShares. “It’s the next big thing after generative AI.”

Competitive considerations color the industry’s forward-looking ways, as more than 40 AI-themed funds have come to market, with “many” of those contraptions “having a hard time attracting cash,” Bloomberg notes.

Indeed, broad bifurcation characterizes the mushrooming actively-managed ETF industry, which grew to $631 billion in 2024 from $81 billion five years earlier per Broadridge Data and Analytics. The cohort comprised only 6% of total ETF assets as of the end of last year, “suggesting significant room for expansion,” the firm writes in a June 12 whitepaper.

Yet capitalizing on that opportunity may prove easier said than done, Broadridge contends, as “a small number of dominant funds and managers capture a disproportionate share of flows.” Of the 814 active ETFs with a track record of at least three years, only 11% managed to raise at least $100 million in assets over their first 12 months, with that contingent growing to $1 billion on average two years later and collectively accounting for two-thirds of total actively-managed industry AUM.

How to reach those rarified ranks? A muscular distribution network among registered investment advisors is one key determinant of success, Broadridge reckons, alongside brand recognition and “unique investment strategies.”

With respect to that final virtue, an upcoming offering from Tuttle Management surely fits the bill. Yesterday, the firm filed a preliminary prospectus for the Government Grift ETF, an actively-managed vehicle “that seeks to achieve long-term capital appreciation by investing in equity securities and related instruments associated with government insiders and political influence.” To that end, Tuttle will undertake “proprietary, multi-step process that combines systematic screening of public disclosures, sentiment analysis, and active portfolio management.”

Bloomberg’s Henry Jim, who highlighted that SEC filing on X, writes that Tuttle will be “working” for its 75 basis points in annual fees, as the strategy calls for regular review of Congressional portfolios, corporate interaction with White House insiders, presidential speeches, interviews and social media posts. Holdings will be reviewed weekly, and the manager may “go all cash if all hell breaks loose.”

Recap June 27

A mid-afternoon hiccup interrupted the now customary strength in stocks, though the S&P 500 staged a snappy recovery into the bell to log a 0.5% advance, good for fresh highs. Treasurys came under modest pressure with 2- and 30-year yields rising three and four basis points, respectively, to 3.73% and 4.85%, while WTI crude stayed at $65 a barrel and gold sank nearly 2% to $3,273 per ounce. Bitcoin hovered near $107,000 while the VIX settled at 16 and change.

- Philip Grant

Passport in a Storm

Eat your hearts out, Hamptonites. From the BBC:

North Korea is opening a beach resort that its leader Kim Jong Un hopes will boost tourism in the secretive communist regime, state media reports.

Wonsan Kalma on the east coast will open to domestic tourists on 1 July, six years after it was due to be completed. It is unclear when it will welcome foreigners.

Or let them leave, once they’ve arrived.

Two for the Money

Choose your own adventure:Choose your own adventure: Slow goings in the mergers and acquisitions realm of late shine a renewed light on the bruising competition to finance such transactions.

Citing data from JPMorgan Chase, Bloomberg relays that the dollar value of newly-issued direct loans has slumped 8% year-over-year for 2025, while broadly-syndicated bank debt has absorbed a 36% downshift from last year’s pace. Borrowers, meanwhile, have refinanced a net $17 billion of deals from leveraged loans to private credit, reflecting “a dynamic recalibration of risk, pricing and structure across credit markets,” as Moody’s global head of private credit, Marc Pinto, puts it.

“Refinancing from private credit to broadly syndicated loans may improve liquidity and broaden investor access, but could also expose the borrower to market volatility,” Pinto added. “Conversely, moving from BSLs to private credit may offer more bespoke terms but at the cost of transparency and secondary market depth.”

This year’s downshift in activity may erode the loan market’s liquidity edge, a new report from Moody’s contends, particularly for lower-rated borrowers. However, that cohort has an ace up its sleeve, thanks to the drift towards ever more forgiving contractual covenants.

Thus, the ratings agency highlights the increasing prominence of “the permitted alternative security carveout,” a negotiated stipulation empowering the debtor to secure liens or guarantees which stand senior to existing first-lien debt in the capital structure.

That feature “can lower financing costs for bolt-on acquisitions, even for riskier borrowers,” Moody’s notes. Yet for existing creditors, “this is potentially a nightmare scenario as the issuer’s business grows and leverage increases, but those creditors are not secured by their ratable share of the expanded enterprise despite the dilution of their existing claims.” Roughly 9% of the credit agreements that Moody’s has reviewed since the start of 2024 include permitted alternative security debt baskets, which can accommodate bolt-on deals ranging from 50% to 250% of the acquiring firm’s Ebitda, “a strikingly large amount.”

A Wednesday bulletin from Bloomberg, meanwhile, illustrates the strikingly homogeneous state of play within private credit. On a monthly basis, credit traders at JPMorgan rifle off price runs across Wall Street indicating their interest in purchasing dozens of closely-held loans, generally bidding at generous prices. Yet those efforts have proved all but fruitless, as “almost no one in private credit is willing to sell.”

Competitive considerations help explain private credit’s cold shoulder to that leveraged loan mainstay, though Bloomberg also points to another potential motivation: If JPMorgan “is successful in creating a vibrant trading market for the loans, it could shatter the perception – or mirage, as critics would argue – of price stability that they’ve spent years selling to investors.

“The value of the loans, the pitch goes, won’t ever get whipsawed around, and dragged down, by the vagaries of the broader markets because they are privately held assets. But if they trade regularly, price levels get marked, day after day, and private credit suddenly doesn’t look that different than its public market counterparts.”

QT Progress Report

A $3.3 billion weekly decline in Reserve Bank credit leaves the Fed’s portfolio of interest-bearing assets at $6.628 trillion. That’s down just $9 billion from the final Thursday in May, and 25.7% south of the March 2022 peak.

Recap June 26

The bulls maintain full command as the S&P 500 rolled higher by 0.8% to reach the cusp of its February peak, while growing momentum for Fed rate cuts helped push two-year Treasurys lower by a further four basis points to 3.7%, extending the five-session drop to nearly a quarter percentage point. WTI crude held at $65 a barrel and change, gold traded flat at $3,330 per ounce, bitcoin did the same near $108,000 and the VIX stayed below 17.

- Philip Grant

Heart of the Matter

Time to rest easy, via medical industry publication Cardiovascular Business:

The American College of Cardiology (ACC) is embracing, more than ever before, the cardiovascular benefits of weight loss medications such as semaglutide and tirzepatide.

Previous recommendations stated that patients should try exercise and other lifestyle interventions to lose weight before choosing pharmaceutical solutions.

Now, however, the ACC is recommending that cardiologists and other healthcare providers consider these medications as a first-line treatment option for eligible patients.

Failure to Launch

Let's make a deal, please:Let’s make a deal, please: The New York Stock Exchange and Nasdaq are drawing up plans to ease their listing requirements in concert with the Securities and Exchange Commission, Reuters reports, as the bourses look to drum up business.

Potential fixes include slashing disclosure requirements and trimming IPO-related costs, along with curtailing the ability of minority investors to lobby for corporate changes by launching proxy contests. The initiative, part of the Trump administration’s drive to slash regulatory red tape, could mark the most significant capital markets reform since the Obama-era Jumpstart Our Business Startups (JOBS) Act.

Post-plague 2021 represents a noteworthy outlier for the otherwise dormant IPO industry, as newly-public firms valued at $50 million and above scared up $142.4 billion in that hyperactive annum per Renaissance Capital. Over the subsequent three and a half years, such fundraising registered at a combined $72.2 billion. More broadly, the tally of U.S. listed companies stands at some 4,500 by Nasdaq’s count, equivalent to 13 per one million citizens. That ratio registered at 30:1 as of 1996 according to the World Bank.

“We need to make the public markets attractive because that is really how you democratize access to these companies,” Nasdaq President Nelson Griggs told Reuters. An SEC spokesperson likewise commented that the agency “is considering addressing regulatory burdens that undermine capital formation, including [ensuring] that IPOs are again something that companies are eager to do.”

As Washington and Wall Street work to breathe life into moribund equity capital markets, an industry upstart leans on a pair of bull-market pillars to get a competing initiative off the ground. The Wall Street Journal reports that startup trading platform Republic “plans to use blockchain technology to sell investors exposure to SpaceX.”

Republic relays that it is now offering digital tokens tracking the performance of Elon Musk’s closely-held firm on the secondary market and plans to expand the offering to other off-exchange, household names such as OpenAI and Anthropic.

Yet as the Journal notes, “plenty of questions” surround that enterprise, as token buyers won’t be able to access corporate financials nor will hodlers attain an actual equity stake. Republic rather describes the ducats as notes “assur[ing] token holders will be paid any increase in the price of SpaceX’s common stock if it goes public or is purchased.

As for potential pushback from regulators, CEO Kendrick Nguyen pointed to JOBS Act provisions allowing for limited retail fundraising by private firms, adding that his outfit need not seek permission from the underlying businesses because the tokens “represent securities sold by Republic.”

It’s counterparty risk for the 21st Century.

Recap June 25

Stocks and Treasurys each snoozed through a consolidation day after the recent risk bacchanal, with the S&P 500 settling little changed while two-year yields ticked lower by a single basis point to 3.74% and the long bond remained at 4.83%. WTI crude and gold each bounced to $65 a barrel and $3,333 per ounce, respectively, bitcoin rose towards $108,000 and the VIX slipped below 17.

- Philip Grant

Script and Score

From The Wall Street Journal:

Abridge, a startup that has automated doctors’ note-taking with artificial intelligence, on Tuesday said it had raised $300 million in funding.

The round, led by venture-capital firm Andreessen Horowitz with participation from Khosla Ventures, values the startup at $5.3 billion. In February, Abridge raised $250 million at a valuation of $2.75 billion.

The new capital infusion will go to hiring scientists, machine-learning experts and software developers who will focus on developing new products and building advanced AI infrastructure to support large customers, said Co-founder and Chief Executive Dr. Shiv Rao.

Heat Check

Mr. Market turns up the temperature:Mr. Market turns up the temperature: The speculative-grade credit market is operating at a blistering pace, as more than $10 billion of new U.S. leveraged loans launched yesterday by Bloomberg’s count, the busiest single session since March 3. That slate of a dozen transactions included nine refinancing or repricing deals, with another pair of borrowers earmarking proceeds to fund dividend payouts for their p.e. promoters.

Similarly, eight high-yield bond sales launched Monday, marking the most active day since January. Among that cohort: an offering to help fund 3G Capital’s leveraged buyout of footwear concern Sketchers U.S.A., which includes $2.5 billion in unsecured pay-in-kind toggle notes permitting the borrower to defer cash interest by adding to the principal balance. Overall month-to-date junk bond supply of $26 billion stands nearly 50% above that seen throughout June 2024.

Yet today’s bright-and-sunny backdrop is largely confined to larger issuers, Bloomberg’s James Crombie writes, as investors are “shunning companies with too much debt relative to earnings – regardless of sector – which tend to be smaller borrowers.” Thus, Russell 2000 Index components sporting market capitalizations of $5 billion and above carry net debt of just above trailing 12-month Ebitda on average, near the lower end of the past five years. Firms valued below $2 billion, however, tote more than 2.5 turns of leverage, the highest figure since 2020.

“Small caps are more impacted by the supply chain disruption and rising input costs caused by trade wars than larger entities are,” Crombie continues. “In addition, they’re disproportionately affected by labor shortages exacerbated by a White House crackdown on immigration.” Still-elevated borrowing costs relative to the post-2008 norm, meanwhile, inform a recent uptick in non-accruals on small business loans, Bank of America finds, alongside an increased use of short-term credit lines to cover day-to-day operating expenses.

Fortunately for smaller borrowers operating outside the public eye, Washington may soon extend a helping hand. The Financial Times reports today that lawmakers “are considering a multibillion-dollar tax break for private credit funds” by trimming dividend duties paid by business development companies, a close proxy for the industry (Blackstone, Apollo and other leading lights have recently established BDCs to help gather funds from individual investors).

The provision was initially removed from the Senate’s draft version of the Trump administration’s big, beautiful bill which passed the House of Representatives last month, but could soon return “amid fierce lobbying,” the pink paper relays. Those industry proponents “have argued that tax breaks would . . . allow [BDCs] to lend more money to mid-sized U.S. companies.”

Direct lenders need little encouragement on that score, as private credit remains all the rage. BDC fundraising reached nearly $44 billion in 2024 per investment bank Robert A Stanger & Co., up more than 70% from the prior annum.

Recap June 24

Another rip higher in stocks left the S&P 500 on the cusp of a new peak following a1.2% advance, while a 1.5% rally in the tech-heavy Nasdaq 100 vaulted that gauge to fresh highs. Treasury yields dipped across the curve following a recent spate of dovish Fed rhetoric, with 2- and 30-year yields wrapping up the session at 3.75% and 4.83%, respectively, while WTI crude lurched lower to $65 a barrel and gold retreated to $3,323 per ounce. Bitcoin climbed above $106,000 while the VIX settled at 17 and change.

- Philip Grant

Bar None

From the Financial Times:

Germany and Italy are facing calls to move their gold out of New York following President Donald Trump’s repeated attacks on the U.S. Federal Reserve and increasing geopolitical turbulence.

Fabio De Masi, a former Die Linke MEP who joined the leftwing populist BSW party, told the Financial Times that there were “strong arguments” for relocating more gold to Europe or Germany “in turbulent times.”

Germany and Italy hold the world’s second- and third-largest national gold reserves after the U.S., with reserves of 3,352 tons and 2,452 tons, respectively, according to World Gold Council data.

Both rely heavily on the New York Federal Reserve in Manhattan as a custodian, each storing more than a third of their bullion in the U.S. Between them, the gold stored in the U.S. has a market value of more than $245 billion, according to FT calculations.

Swing and a Prayer

Go West, young man:Go West, young man: youthful investors are looking far afield in service of satisfactory returns, Bloomberg documents, as the number of retail clients holding pre-IPO unicorns, private equity, cryptocurrencies and other alternative assets has more than doubled since 2020.

More than 90% of BofA surveyed wealth-management customers under the age of 43 intend to increase their allocation to alternatives in the coming years. The daily pace of signups on pre-IPO trading platform Forge Global, meanwhile, have more than tripled since the firm slashed its minimum investment on some products to $5,000 from $10,000-plus in March.

“It’s often easier to convince an entrepreneur to put money into a 1-in-10 shot startup than it is to get them to park money in a conservative, long-term strategy,” Brian Werner, CIO at financial advisor Winthrop Partners, relates to Bloomberg. “You’ve got this mix of investor preferences and product availability evolving in a way that they actually complement each other to create this procyclical uptake in alternative investments,” added Michael Pelzar, head of investments at BofA private bank. “We’re probably in the early innings of a real wave.”

So-called bitcoin treasury firms present a fitting avatar for that phenomenon, as the 3,000%, five-year rally in Michael Saylor’s Strategy (née MicroStrategy) has coaxed a litter of copycats to the fore. A high-profile entrant joined those ranks Monday, with ProCap Financial announcing plans to go public via merger with blank check firm Columbus Circle Capital Corp.

ProCap, helmed by former Facebook staffer turned crypto-evangelizing podcaster Anthony Pompliano, raised $750 million in equity and convertible debt while targeting a $1 billion bitcoin portfolio and planning to generate revenue via a bitcoin-denominated financial services operation. “There’s an old George Soros quote that goes, ‘when I see a bubble forming, I rush in to buy, adding fuel to the fire,’” Pompliano told CNBC this morning. “There’s a reason the bubble forms – because the trend works.”

See “Bitcoin goes corporate” in the current edition of Grant’s Interest Rate Observer dated June 20 for a closer look at the corporate crypto craze and its potential consequences, along with “The great inverted pyramid revisited” for more on the proliferation of illiquid securities across the financial system.

Recap June 23

Iran’s modest response to the weekend U.S. campaign helped send WTI crude tumbling 8% to $67 per barrel, while the S&P vaulted 1% to leave the broad index roughly 2% below its February peak. Treasurys dropped to 3.84% on the two-year note and 4.87% on the long bond, down six and two basis points, respectively, while gold traded sideways at $3,372 per ounce. Bitcoin advanced to $104,000 and the VIX ebbed below 20.

- Philip Grant

Poke and Dagger

From The Wall Street Journal:

A U.S. official told top global semiconductor makers he wanted to revoke waivers they have used to access American technology in China, people familiar with the matter said, a move that could inflame trade tensions.

Currently, South Korea’s Samsung Electronics and SK Hynix as well as Taiwan Semiconductor Manufacturing enjoy blanket waivers that allow them to ship American chip-making equipment to their factories in China without applying for a separate license each time. . .

If carried out, the move could be disruptive both diplomatically and economically. Earlier this month, the U.S. and China agreed to a fragile trade truce in London. Part of the deal involved each country agreeing to hold off from introducing new export controls and other measures designed to hurt the other.

Action Park

Out with the old, out with the new:Out with the old, out with the new: The Securities and Exchange Commission is undertaking a comprehensive policy pivot under new broom (and former crypto lobbyist) Paul Atkins, the Financial Times relays today, “throwing out more than a dozen rules proposed by his predecessor” Gary Gensler. Regulatory initiatives governing cybersecurity-related risk disclosures, artificial intelligence and, of course, cryptocurrencies are on the chopping block, as Atkins – “a champion of light touch regulation” – draws up a new playbook for digital assets.

“As the chairman has said, we are getting back to our roots of promoting, rather than stifling, innovation,” an SEC flack told the pink paper. “The markets innovate, and the SEC should not be in the business of telling them to stand still.”

A cryptocurrency mainstay is set to put the regulator’s laissez-faire bona fides to the test. Coinbase is seeking SEC approval to offer tokenized equities, meaning digital representations of stocks transacted via the blockchain, chief legal officer Paul Grewal told Reuters Tuesday, adding that the project is a “huge priority” for the digital exchange.

Last month, rival bourse Kraken announced it will launch xStocks tokens, which track U.S. equities, in select overseas markets, but a stateside initiative will likely require the SEC to issue a “no action letter” indicating it does not object. “With a no-action letter, an issuer of a tokenized equity. . . can have some confidence, some comfort, that the SEC has adopted its view of why this product is important,” Grewal told Reuters. “It’s that confidence that has been lacking so far, and I think [has] really held back a lot of the institutional adoption” of crypto.

As digital asset purveyors push await the regulatory green light, malefactors across the globe unveil their latest innovation: citing research firm Cisco Talos, CoinDesk relays today that “North Korean hackers are targeting top crypto firms with malware hidden in job applications.”

It’s a kind of progress.

Recap June 20

Stocks settled slightly lower on the S&P 500 after an initial upside burst ran out of steam, while Treasurys put in a mixed showing with two-year yields dipping four basis points to 3.89% and the long bond edging to 4.89% from 4.88% Wednesday. WTI crude settled at $74 a barrel, gold traded sideways at $3,369 per ounce, bitcoin ebbed below $104,000 and the VIX dropped below 21.

- Philip Grant

Forma and Void

Spanish waste management concern UrbaserSpanish waste management concern Urbaser looked to give its financial statements a power-wash in a recent debt offering, as Bloomberg reports the firm initially included a contractual provision which would have excluded tariff-related costs from its calculation of Ebitda (earnings before interest, taxes, depreciation and amortization).

Urbaser, which operates in 15 countries, ultimately scrapped the provision from its €2.3 billion ($2.7 billion) high-yield bond and term loan package, which will be used to refinance existing obligations and pay a dividend to its p.e. promoter Platinum Equity. Nonetheless, the attempted gambit sent eyebrows aloft: “The basic issue with this add-back [meaning an imagined future cost savings or other profitability-boosting measure], and many provisions these days, is that it fails to take into the account the borrower’s commercial reality,” Sabrina Fox, founder and eponym of Fox Legal Training, told Bloomberg.

Such gussied-up financial statements have long bedeviled some observers, with a seminal June 2000 analysis from Moody’s Investors Service concluding that Ebitda itself “can drift from the realm of reality.”

The rating agency warned that the metric “can easily be manipulated through aggressive accounting policies relating to revenue and expense recognition, asset write-downs and concomitant adjustments to depreciation schedules. . . and by the timing of certain ‘ordinary course’ asset sales.”

Ebitda’s rise to prominence has proved a boon to deal-doers, Moody’s likewise argued, “creat[ing] an illusion of making acquisition prices appear smaller. For example, a 6.5 times Ebitda multiple for a company whose Ebitda consists 50% of Ebita and 50% of depreciation equates to a materially higher 13 times multiple of operating earnings plus amortization.”

Of course, that view now appears positively quaint, as the supersonic p.e. boom and ZIRP-era reach for yield encouraged further flattery of that forgiving earnings gauge. During the first quarter of 2016, for instance, Covenant Review found that more than 80% of new leveraged loans capped the dollar value of projected cost savings that promoters could use to enhance pro-forma profitability. Two years later, that share slipped below 50%. See the Aug. 10, 2018 edition of Grant’s Interest Rate Observer for a contemporary analysis of the wobbly architecture underpinning p.e.’s perch.

The post-pandemic jump in borrowing costs has knocked the buyout business down a peg, with State Street’s private equity index underperforming the S&P 500 on a one, three, five and 10-year basis through 2024 while limited partner distributions as measured by Cambridge Associates sagged to half their long-term norm last year.

Shifting financial weather and all, Ebitda add-backs remain a hallmark of the p.e. industry. An April S&P Global analysis of 650 M&A and leveraged buyout transactions spanning 2015 to 2023 found a “clear correlation between the magnitude of add-backs at deal inception and the severity of management projection misses.”

Thus, add-backs accounted for 28% of Ebitda on a median basis over the life of the study, with reality rarely conforming to those sunny projections: only 8% of surveyed firms met or exceeded earnings projections in the first year following deal inception, with that figure increasing to still-modest 17% in year two. Actual Ebitda missed the mark by 32% and 34% on a median basis in years one and two, respectively, leaving median leverage higher by 2.3 and 2.6 turns relative to the initial forecast.

“[P.e.] sponsored transactions significantly underperformed nonsponsored transactions,” the ratings agency likewise relays, with median leverage among that sub-category topping projections by 2.7 turns in year one and 2.9 turns in the following annum. “This suggests that inflated add-backs may help companies with higher financial risk get deals done.”

Recap June 19

Markets were mostly closed Thursday for Juneteenth, though S&P futures came under pressure to the tune of a near 1% decline, with WTI crude retreating back towards $75 a barrel from a foray north of $77 and gold slipping to $3,369 per ounce.

- Philip Grant

Nudge Report

From Reuters:

Spanish lender BBVA is advising wealthy clients to invest up to 7% of their portfolio[s] into cryptocurrencies, an executive said on Tuesday, in the latest sign some banks are warming to a sector long avoided by mainstream finance because of its risks.

BBVA's private bank advises clients to invest 3% to 7% of their portfolio in cryptocurrencies depending on their risk appetite, Philippe Meyer, head of digital & blockchain solutions at BBVA Switzerland, told the DigiAssets conference in London. . .

While many private banks execute client requests to buy cryptocurrencies, it is relatively unusual for them to advise them to actively buy them.

All in the Family

“Obscure Chinese stock scams dupe“Obscure Chinese stock scams dupe American investors by the thousands,” splashed a Monday headline in The Wall Street Journal. As the piece detailed, an array of Middle Kingdom-based outfits have flocked to U.S. exchanges, with promoters utilizing social media and WhatApp to hype a given company’s prospects while manipulating shares higher prior to the ultimate rug-pull. The Justice Department “is now involved with fighting the fraud,” the WSJ relays.

Nearly 60 firms based in mainland China have launched small IPOs (raising $15 million or less) on the Nasdaq exchange over the past five years according to FactSet, with more than one-third of that cohort suffering one-day price drops of 50% since mid-2023. An additional 17 Hong Kong-headquartered, Nasdaq-listed outfits have seen half their market capitalization disappear during a single session.

Back in November 2022, the Financial Industry Regulatory Authority warned that such China-based, U.S.-listed small fry often allocate the bulk of their IPO shares to Hong Kong broker dealers and nominee accounts, in which a U.S. broker holds securities on behalf of foreign nationals. FINRA likewise flagged “possible centralized control” over those nominee accounts, including similar customer contact information, bank data and IP addresses.

For its part, the Nasdaq has implemented a perhaps-belated tightening of its listing protocols, obliging firms from China and other so-called restrictive markets to raise at least $25 million. “The idea is that when there are enough shares in the market, it reduces the likelihood of wild price swings,” Daniel McClory, head of equity capital markets at Boustead Securities, told the Journal.

Yet enhanced regulatory scrutiny on the small-cap China cohort runs headlong into the renewed rampage in animal sprits. To that end, shares of Hong Kong-based Regencell Bioscience Holding Ltd. (ticker: RGC) rose an additional 30% Tuesday after ripping 288% a day ago on the strength of a 38:1 stock split. Following year-to-date gains of 59,900%, the firm now sports a $38.5 billion market cap. That figure tops 16 components of the blue-chip Nasdaq 100 Index.

Regencell, which was founded in 2014 and debuted on the Nasdaq in 2021, is in the business of developing Chinese herbal medicine treatments for childhood attention deficit hyperactivity disorder, though the firm has yet to generate revenue or apply for any regulatory approvals and posted a $4.4 million loss over the 12 months through June 30. As Bloomberg notes today, CEO Yat-Gai Au owns 86% of shares outstanding, vaulting his paper wealth beyond the likes of SoftBank boss Masayoshi Son and Dallas Cowboys owner Jerry Jones.

Referencing Regencell and its affiliated foundation, the company website describes the CEO thus: “Both entities are Gai’s passion projects, and he will continue to invest his personal funds to defend what he believes in. He has literally put his money where his mouth is by investing over $9 million in RGC to demonstrate his personal belief and commitment.”

Recap June 17

Stocks and yields both dropped Tuesday, with the S&P 500 shedding 0.8% to maintain its recent ping-pong price action, while 2- and 30-year Treasurys ebbed to 3.94% and 4.88%, respectively, from 3.97% and 4.96% Monday. WTI crude rallied to $73.50 per barrel, spot gold finished little changed at $3,384 per ounce, bitcoin sank below $105,000 and the VIX jumped to 21.5, up more than two points on the session.

- Philip Grant

Offense Wins Championships

From CNBC:

“In finance, when you’re playing defense, you’re almost certainly losing,” [Ken] Griffin said to Citadel’s new class of summer interns Thursday evening. “There’s no other way to put it. Every time a portfolio manager tells me ‘I’m going on defense,’ I’m waiting to watch the red because that tends to be what happens next.”

Griffin, whose hedge fund oversees $66 billion in assets as of June 1, thinks cash would be a better place to hide out than what are often considered “safe trades” in a risk-off environment.

“If you are going on defense, just go to cash. Otherwise, you’re just in the ‘safe trades,’ where everyone else has already gone — and the safe trades are often where the losses are,” he said.

North by Northeast

Persistent price pressures are bedeviling the Bank of Japan,Persistent price pressures are bedeviling the Bank of Japan, Bloomberg relayed Thursday, with the monetary mandarins upgrading their inflation assessment ahead of the two-day policy meeting which concludes tomorrow. Japanese CPI excluding fresh food and energy rose at a 3% annual clip in April – the eighth sequential year-over-year acceleration in the past nine monthly prints – against a backdrop of 0.5% benchmark borrowing costs and largely status-quo investor expectations (interest rate futures point to little change to that overnight rate through the summer and a 0.65% bogey at year-end).

Bearish bond market dynamics likewise loom large over this week’s gathering, as 20- and 30-year Japanese government bond yields each marked multi-decade highs late last month, with 40-year borrowing costs ascending to a record 3.69%.

By way of response, roughly two-thirds of Bloomberg-surveyed economists expect that the BoJ will announce plans to slow down the tapering of open-market bond purchases from the ¥400 billion ($3 billion) per-quarter downshift introduced last summer. Better a bit more inflation than a busted bond market, the thinking may go.

The BoJ, which owns roughly half of all JGBs, whittled down its portfolio by ¥6.2 trillion during the first three months of the year, a record figure dating to 1996. That sum, however, pales in comparison to typical quarterly net purchases over the past decade, which routinely approached or eclipsed ¥20 trillion.

Stateside creditors may want to take heed of the BoJ’s decision. “Treasurys have become more sensitive to moves in Tokyo,” a Monday analysis from Bloomberg concludes, with correlations between those bond markets rising to their highest levels since 2020. Japanese investors represent the largest foreign contingent of U.S. bondholders, while the land of the Rising Sun commands a 16.7% weighting in the Bloomberg Global Treasury Total Return Index, second only to the U.S.

“The rise in Japan bond yields has meaningful spillover impacts globally,” commented Freddy Wong, head of Asia Pacific fixed income at Invesco. “As JGB yields rise, the relative attractiveness for sovereign bonds in other parts of the world decreases, which drives selloffs and increases volatility in other. . . markets.”

Recap June 16

Friday’s stock market dip gave way to the requisite rebound, with the S&P 500 storming higher by some 1% at the open and cruising sideways from there, while Treasurys remained under pressure in bear-steepening fashion as 2- and 30-year yields rose one and six basis points, respectively, to 3.97% and 4.96%. WTI crude pulled back below $72 a barrel, gold retreated to $3,385 per ounce, bitcoin rebounded to $108,600 and the VIX settled just above 19.

- Philip Grant

Sea Sharp

Liquidity, provided. From Financial Times:

Jane Street has struck one of Hong Kong’s largest prime office leases since before the Covid-19 pandemic, underlining how the New York-based trading firm has emerged as a challenger to Wall Street’s biggest banks.

Under the deal, which relates to a central business district complex still under development, Jane Street will pay an estimated rent of more than HK$30 million per month ($3.8 million) for a five-year lease of six floors starting in 2028. . .

Henderson Land said that the lease “marks the largest single office leasing transaction for Hong Kong’s Central Business District in decades.”

Tool Time

Summer’s approach has brought no thaw to the largely frozen U.S. housing market,Summer’s approach has brought no thaw to the largely frozen U.S. housing market, as pending home sales dipped 1.1% year-over-year over the four weeks through June 8 to 87,720 units according to Redfin. That’s a record low for this time of year in data spanning to 2015.

With benchmark mortgage rates stuck near 7% and median sales prices reaching a record high of $441,500 in May, that punishing affordability picture takes a heavy toll. Just over 28% of U.S. housing transactions took place above the asking price, the data firm finds, down from 53% at this time in 2022 and the lowest springtime share since Covid-addled 2020. The number of would-be sellers outpace buyers by nearly 500,000 nationwide, the largest gap in at least a dozen years.

Today’s forbidding backdrop is likewise on display within new dwelling development. Housing starts retreated to a 1.36 million annualized clip in April from 1.82 million three years earlier, while the National Association of Homebuilders’ sentiment gauge matched the lowest reading since late 2022 last month. Investors are, in turn, steering clear, with the S&P Homebuilders Select Industry Index returning minus 12% over the last year, lagging the broader blue-chip gauge by two dozen percentage points.

One countervailing dynamic takes the sting out of that slowdown for some operators. Last week, Bloomberg highlighted boomtime conditions in home equity financing bonds, whereby, in return for ceding a portion of their home’s equity, borrowers receive cash upfront to pay for remodeling and renovation projects.

Some $18 billion of the bonds came to market last year per data from Deutsche Bank, triple that seen in 2023. Sales of those instruments are tracking at a similar pace to 2024 in the year-to-date. Aggregate nationwide home equity stood at $34.5 trillion as of March 31 per the Federal Reserve, down from the record $35.6 trillion logged last summer but up 71% over the prior five years.

To that end, analysts at Barclays wrote Monday that “home improvement remains one of the few discretionary [spending] categories doing well year-to-date that’s not under the trade-down label, perhaps suggesting that trends can continue to diverge” from the soft housing market.

See the May 23 edition of Grant’s Interest Rate Observer for a bullish analysis of a construction products mainstay poised to benefit from those repair-and-remodel tailwinds, while enjoying notable insider share purchase activity (three insiders have splashed out a combined $56 million on company stock over the past five weeks) alongside a valuation stuck at “submarket multiples on depressed earnings.”

Recap June 13

Risk aversion reigned following Israel’s overnight attack on Iran, with WTI crude oil vaulting towards $74 per barrel, up 8% on the session and 13% on the week, while the S&P 500 retreated 1.1%, finishing near session lows. Gold jumped nearly 2% to $3,433 per ounce, bitcoin retreated to $105,300 and the VIX advanced three points to 21. Notably, Uncle Sam’s obligations proved no port in the storm, as 2- and 30-year Treasury yields each rose six basis points to 3.96% and 4.9%, respectively.

- Philip Grant